Before entering into any Project Portfolio Management (PPM) solution, most businesses will want to see a strong Business Case to ensure there is a clear need to invest. The evidence from Bestoutcome and other industry research suggests that our clients can expect to gain a return on investment in 6 to 9 months and make significant savings annually by using such PPM technology.

In this white paper, learn how to develop an attractive and fact-based Business Case for PPM, and discover independent research proving the benefits achievable through PPM solutions.

Organisations turn to PPM solutions for many different reasons, but these are usually focused on the need for greater clarity in terms of management control, clarity in terms of delivery, or insight in terms of strategic thinking. It would seem that senior management teams today are increasingly looking for clear answers to such fundamental enquiries as:

PPM tools help to introduce order and visibility around these issues — but any financial outlay needs to be supported with hard data evidence of effectiveness.

It has been found in independent research that organisations using PPM tools can experience financial success in less than a year. If you are interested in understanding how to make such benefits in your organisation, read the following whitepaper.

Like any other proposal regarding an investment, any PPM Business Case needs to ensure that it communicates the following:

PPM programmes can comprise both process and technology changes; hence, care needs to be taken when crediting improvements in both aspects, rather than merely in the technology itself.

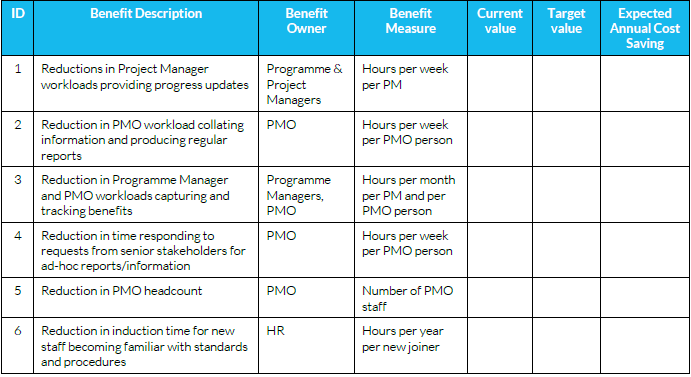

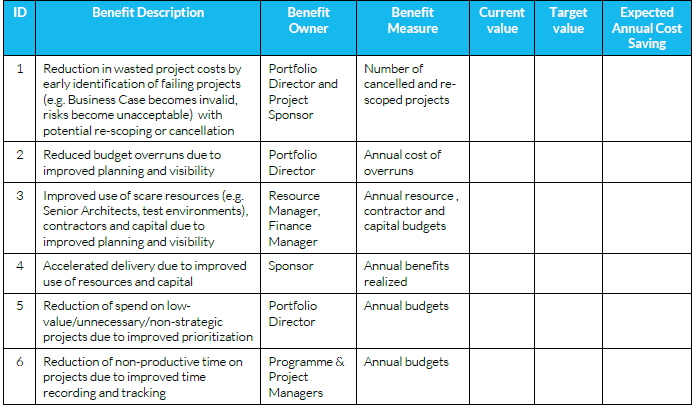

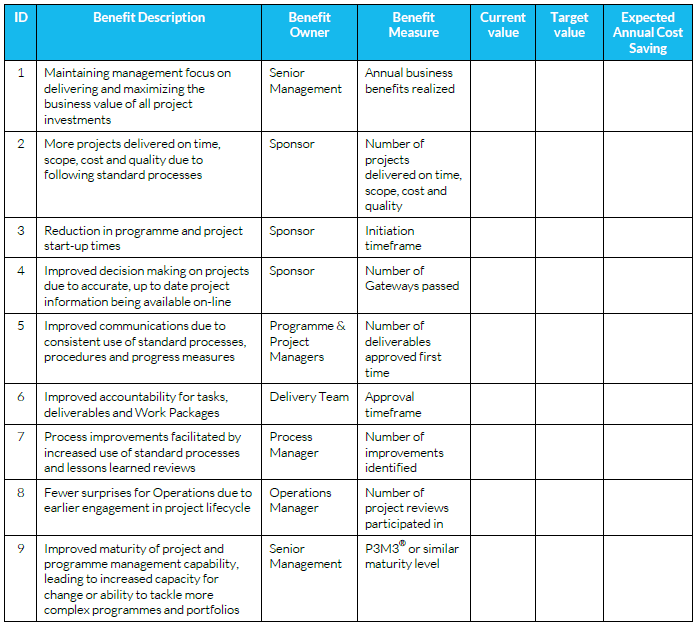

They usually comprise benefits under three categories:

To make an economic case to invest, there has to be baseline information, which involves having a clear understanding of how the organisation is functioning today. Benefits management has to make measurable claims.

To reduce PMO reporting effort by 50%, you need to know what the current cost and time are to produce the reports every month before you begin the process of automation.

Although every organisation has its own starting point, PPM tools always deliver direct savings including:

Tangible benefits improve operations in measurable ways. Examples include:

While some of these are hard to quantify at first, they can be measured using KPIs after the baseline is established.

These benefits might not carry direct financial weight but have a strong influence on outcomes. Examples include:

With thoughtful analysis, many of these can be translated into financial terms—like the cost of late detection of project failure due to lack of visibility.

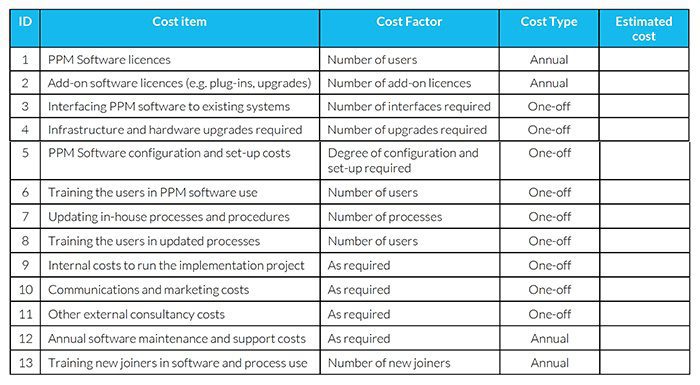

The cost of PPM spans people, process, and technology. Common components include:

These costs should be broken down and aligned with each implementation phase of the selected PPM tool.

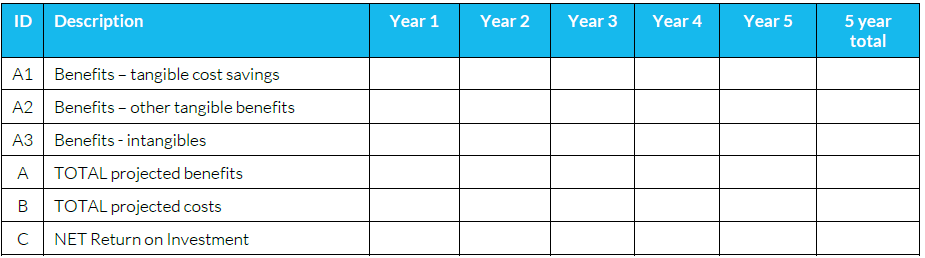

A typical ROI analysis compares implementation costs against realised benefits.

Using the categories above and your organisation’s current metrics, you can model ROI to include:

Table-based modelling can also support ROI cases for executive buy-in.

Several studies confirm the value of implementing PPM solutions:

Analysed eight organisations post-implementation:

Reviewed four organisations:

Studied 13 high-performing organisations:

PPM tools enable leadership to address key questions like:

But to secure funding, you need a convincing, evidence – driven Business Case that clearly shows how PPM enhances performance, cuts costs, and increases value.

Many Bestoutcome clients using PM3 have followed this approach—achieving fast ROI, improved portfolio management, and returns within 9 months.

If you’d like help building your Business Case for PPM — or want to explore how PM3 can deliver value quickly—get in touch. We’re here to help.

Our products help you deliver successful change programmes and projects by always focusing on the overall business outcomes. Find out how our products can help you

Tell me more Request a demoChoosing a PPM Tool can be a fraught and challenging process. Getting it right requires forethought,...

Read more >